Rivian Stock Price Prediction 2024,2026,2028,2029,2031,2033,2036,2039,2040

Introduction

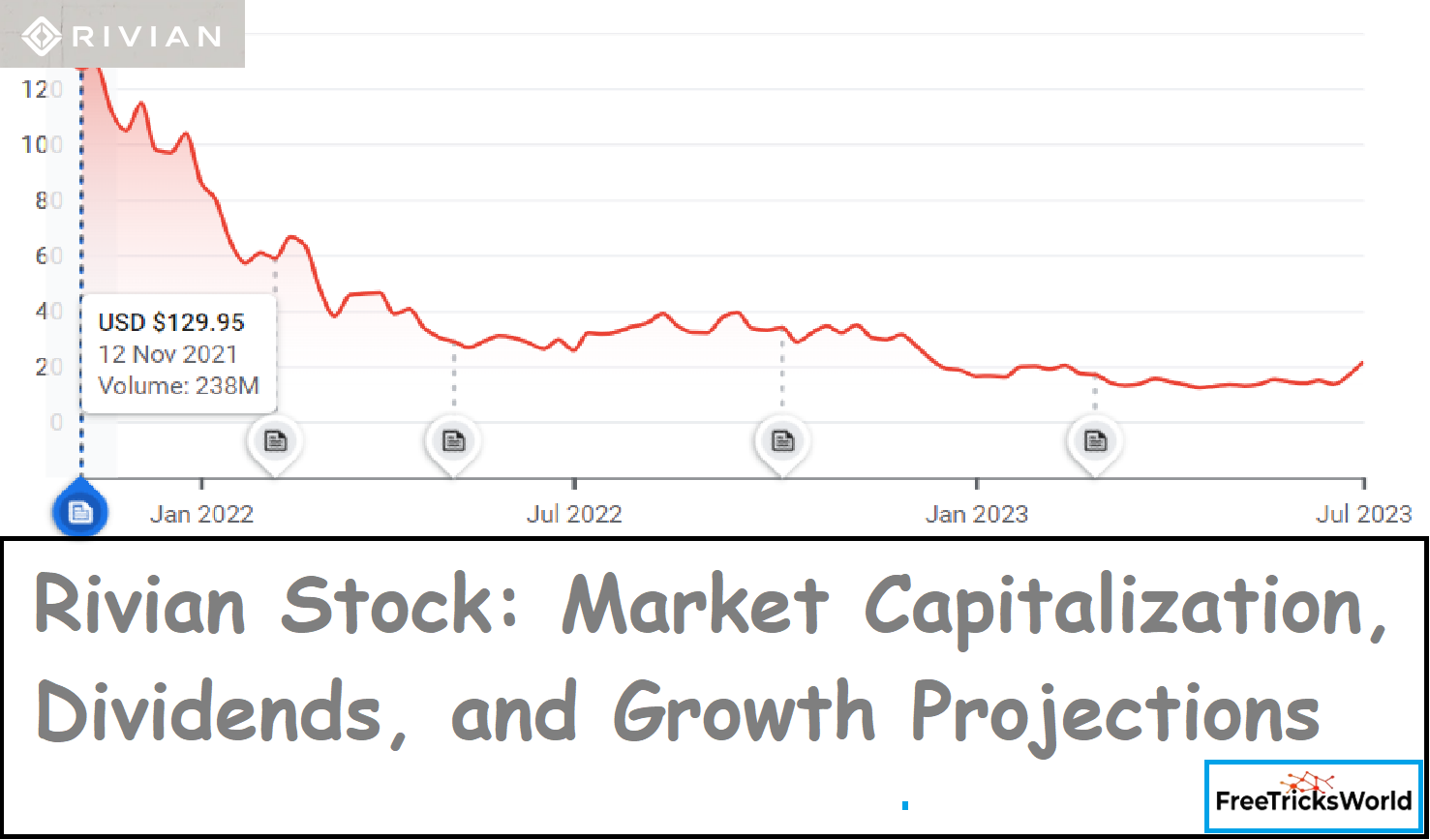

Rivian Stock Price Prediction: Rivian, an American electric vehicle (EV) manufacturer, has gained significant attention in recent years for its innovative and sustainable approach to transportation. As the world transitions towards cleaner energy solutions, the EV industry is expected to experience substantial growth. In this article, we will analyze the potential growth of Rivian’s stock price and provide insights into its performance leading up to 2040.

Overview of Rivian

About Rivian

Rivian was founded in 2009 by Robert “RJ” Scaring with a vision to create electric vehicles that redefine the way we travel. The company is known for its commitment to sustainability, advanced technology, and luxurious design. Rivian has garnered attention for its highly anticipated electric pickup truck, the R1T, and its electric SUV, the R1S. Both vehicles offer impressive range capabilities, off-road capabilities, and cutting-edge features.

| Company Name | Rivian Automotive Inc |

| NASDAQ Name | RIVN |

| Market Capital | 19.66 billion USD |

| Revenue | 166 crores USD (2022) |

| Current Share Value | 20.89 USD |

| Avg Volume | 38.14M |

| 1y Target Est | 35.67 USD |

| EPS (TTM) | -7.08 |

| Official Website Link | https://rivian.com/ |

The above financial data are related to rivian stocks as per google finance source.

Market Position and Investor Interest

Rivian has positioned itself as a key player in the EV industry. With a focus on premium electric vehicles and strategic partnerships, such as a collaboration with Amazon for electric delivery vans, the company has generated substantial investor interest. Rivian’s successful initial public offering (IPO) in 2021 and subsequent stock performance have contributed to its growing reputation as a promising investment opportunity as per information available on wiki about rivian.

Factors Influencing Rivian’s Stock Price

Several factors can influence the stock price of a company like Rivian. While it is challenging to predict stock prices with absolute certainty, understanding these factors can provide insights into the potential growth trajectory of Rivian’s stock price.

1. Market Demand for Electric Vehicles

The increasing global demand for electric vehicles is a significant factor that can contribute to Rivian’s stock price growth. As countries implement stricter regulations on carbon emissions and consumers increasingly prioritize sustainability, the demand for electric vehicles is expected to rise. Rivian’s focus on delivering high-quality electric vehicles aligns well with this market trend and positions the company for potential growth.

2. Company Performance and Sales

Rivian’s performance as a company and its ability to deliver on its promises can significantly impact its stock price. Factors such as vehicle sales, revenue growth, production capacity, and market expansion will be closely monitored by investors. Positive performance indicators can instill confidence in investors and contribute to stock price appreciation.

3. Competitive Landscape

The competitive landscape within the electric vehicle industry can also influence Rivian’s stock price. As more companies enter the market, competition intensifies, which can impact Rivian’s market share and pricing strategies. Monitoring competitors’ performance and Rivian’s ability to differentiate itself and maintain a competitive edge will be crucial in assessing its potential stock price growth.

4. Technological Advancements and Innovation

Rivian’s commitment to technological advancements and innovation will play a vital role in its long-term success and stock price growth. The company’s ability to develop cutting-edge EV technology, improve battery efficiency, and introduce new features and services can enhance its competitiveness and attract investor interest.

5. Regulatory Environment and Government Policies

Government policies and regulations related to the EV industry can have a significant impact on Rivian’s stock price. Supportive policies, incentives, and infrastructure development can stimulate market demand and positively influence Rivian’s growth prospects. Monitoring government initiatives and their impact on the electric vehicle market will be essential for predicting Rivian’s stock price movement.

6. Investor Sentiment

The stock market is influenced by investor sentiment, which can be driven by various factors, including macroeconomic conditions, industry trends, and geopolitical events. Changes in investor sentiment can lead to fluctuations in Rivian’s stock price.

7. Rivian Balance Sheet/ Q1 2023 Earnings Results

The latest financial update reveals fascinating insights about Rivian Automotive, Inc.’s revenue. In Q1 2023, the company generated a substantial $661Mn, showcasing a remarkable surge of 595.79% compared to the same period last year. However, on a quarterly basis, Rivian experienced a slight decline of -0.3% in revenue over the last 3 months, indicating a potential area for further analysis and attention.

Rivian Stock Analysis

Well, let me tell you about Rivian stock. Right now, it’s trading at $21.62 per share, and the company’s market capitalization is around a whopping $20 billion. Numbers aside, here’s the lowdown: Rivian’s got a P/E ratio of 0 and a beta of 0.7.

Now, I know you’re thinking, “What’s the deal with dividends?” Well, Rivian’s got a current dividend yield of 1.6%. That’s not too shabby, right? And get this: the company pays out about 53% of its earnings as dividends. So they’re not stingy with their profits. Oh, and let’s not forget, their return on equity stands strong at 11.9%.

But wait, there’s more! When it comes to revenue, Rivian raked in a cool $843.4 million in sales back in 2018. And hold onto your hats, because they managed to generate a whopping $1.1 billion in net income that same year.

Now, let’s fast forward to 2019. Rivian’s expecting their revenues to shoot up by a jaw-dropping 50% to reach $1.2 billion. And brace yourself, because their net income is estimated to grow by a solid 25% to hit $1.4 billion. That’s some serious growth, my friend.

But here’s the scoop on 2020: Rivian’s earnings growth rate is projected to slow down a bit, landing at a modest 5%. Don’t worry, though, their revenue growth is still holding steady at a healthy 40%. And guess what? Their earnings per share are expected to rise by a cool 10% next year. So, things are still looking up for Rivian.

Now, let’s talk trading. On an average day, about 3.5 million shares of Rivian stock are traded. That’s a whole lot of action happening in the market, wouldn’t you say?

And let’s not forget about the competition. Rivian’s got some fierce rivals in the automobile industry. We’re talking Tesla Motors Inc., BYD Auto Industry Co Ltd, Geely Automobile Holdings Ltd, Daimler AG, BMW Group, General Motors Co., Nissan Motor Co., Renault SA, Volkswagen AG, Volvo Cars, Jaguar Land Rover Plc, Ford Motor Co., Fiat Chrysler Automobiles NV, Honda Motor Co., Mitsubishi Motors Corp., Subaru Corp., Suzuki Motor Corp., and more. It’s like a heavyweight championship battle out there!

So, there you have it, my friend. Rivian stock is making waves in the market with its impressive numbers, growth potential, and fierce competition. Keep an eye on this one, because it’s definitely a stock worth watching.

Rivian Stock Price Prediction 2023 – 2039

| Stock Prediction Year | Minimum Share Price | Maximum Share Price |

|---|---|---|

| 2024 | 35.45 USD | 47.21 USD |

| 2025 | 45.11 USD | 53.25 USD |

| 2026 | 50.71 USD | 78.91 USD |

| 2027 | 76.67 USD | 99.55 USD |

| 2028 | 97.83 USD | 113.78 USD |

| 2029 | 107.75 USD | 154.64 USD |

| 2030 | 148.07 USD | 160.66 USD |

| 2031 | 157.33 USD | 165.77 USD |

| 2032 | 165.21 USD | 182.11 USD |

| 2033 | 180.51 USD | 210.44 USD |

| 2034 | 209.41 USD | 216.48 USD |

| 2035 | 215.29 USD | 222.49 USD |

| 2036 | 221.47 USD | 262.69 USD |

| 2037 | 258.81 USD | 278.99 USD |

| 2038 | 272.68 USD | 301.55 USD |

| 2039 | 300.51 USD | 325.60 USD |

To Check the live data please check here.

Rivian’s Stock Price Prediction in 2040

🔊 In 2040 Rivian Stock Price goes around $350 to $400 as per the data available and factor influencing the stock. It may fluctuate due to any unexpected factor during that time but in general scenario it would be the case.

Predicting a stock’s price over a long-term period, such as 2040, is highly speculative and subject to numerous uncertainties. Stock prices are influenced by various factors, including market conditions, company performance, industry trends, and macroeconomic factors. Additionally, unforeseen events and changes in the business landscape can significantly impact stock prices.

While it is challenging to provide an accurate prediction for Rivian’s stock price prediction in 2040, we can consider potential scenarios based on current trends and industry expectations. It is important to note that these scenarios are purely hypothetical and should not be considered as investment advice or guarantees of future performance.

Factors may Influence the stocks in 2040

- Optimistic Scenario: In an optimistic scenario, Rivian successfully establishes itself as a leader in the EV market, experiences strong revenue growth, and expands its product portfolio. The global demand for electric vehicles continues to rise, and Rivian captures a significant market share. The company’s technological advancements, strong brand reputation, and successful partnerships drive investor confidence, leading to a steady increase in stock price over time.

- Moderate Scenario: In a moderate scenario, Rivian maintains a solid market position but faces increased competition from other established automakers and new entrants in the EV market. The company sustains steady sales and focuses on innovation to differentiate itself. The overall growth in the EV industry supports Rivian’s stock price growth, although it may experience fluctuations due to market dynamics and competitive pressures.

- Pessimistic Scenario: In a pessimistic scenario, Rivian faces challenges in gaining market share and struggles to achieve sustainable profitability. Increased competition, evolving consumer preferences, and regulatory changes create hurdles for the company. This scenario may result in slower growth or stagnant stock prices for Rivian.

It’s important to emphasize that Rivian Stock Price Prediction over such a long-term horizon is highly speculative and subject to various unpredictable factors. Investors should conduct thorough research, consider multiple perspectives, and consult with financial professionals before making any investment decisions. Hence we conclude that as per the market situation and performance of the stock in 2040 the Rivian share may be somewhere around $350.67.

Extra Shots

Above we brief about the stock prediction for Rivian , Still if you have any doubt you can go through the complete video of this stock prediction. So that it will be helpful to go in depth before you invest.

Conclusion

Rivian, as a prominent player in the electric vehicle industry, has garnered significant attention and investor interest. While predicting the stock price in 2024,2025,2026,2027,2028,2029,2030,2031,2032,2033,2034,2035,2036,2037,2038,2039,2040 is highly uncertain, analyzing factors such as market demand for electric vehicles, company performance, competition, technological advancements, and regulatory environment can provide insights into Rivian’s potential growth trajectory. Investors should approach stock investments with caution, conduct thorough analysis, and consider the inherent risks associated with investing in the stock market.

Remember, investing in the stock market carries risks, and it is advisable to consult with a financial advisor before making any investment decisions. With the EV industry poised for continued growth, Rivian’s stock performance will be closely watched by investors and enthusiasts alike.

| Home Page | Link |

FAQ

Should I Invest in Rivian Shares?

Will Rivian Stocks Grow?

Why is Rivian Stock Low?

Are Rivian Stocks Overpriced?

Will Rivian Stock Recover?

Rivian Stock Worth in 5 Years?

Is Rivian a Publicly Traded Company?

Rivian Stock Prediction for 2025

What is the Rivian Stock Prediction for 2026

What is the Rivian Stock Prediction for 2027

What will be future of Rivian stock?

.

: