Top 5 ULIP Plans with Highest Returns in 2025

Unit Linked Insurance Plans (ULIPs) have emerged as a popular financial instrument that combines life insurance with market-linked investments. As investors seek higher returns in 2025, ULIPs offer flexibility, tax benefits, and the potential for wealth creation.

This article evaluates the top 5 ULIP plans expected to deliver the highest returns in 2025, based on historical performance, fund management strategies, and market trends.

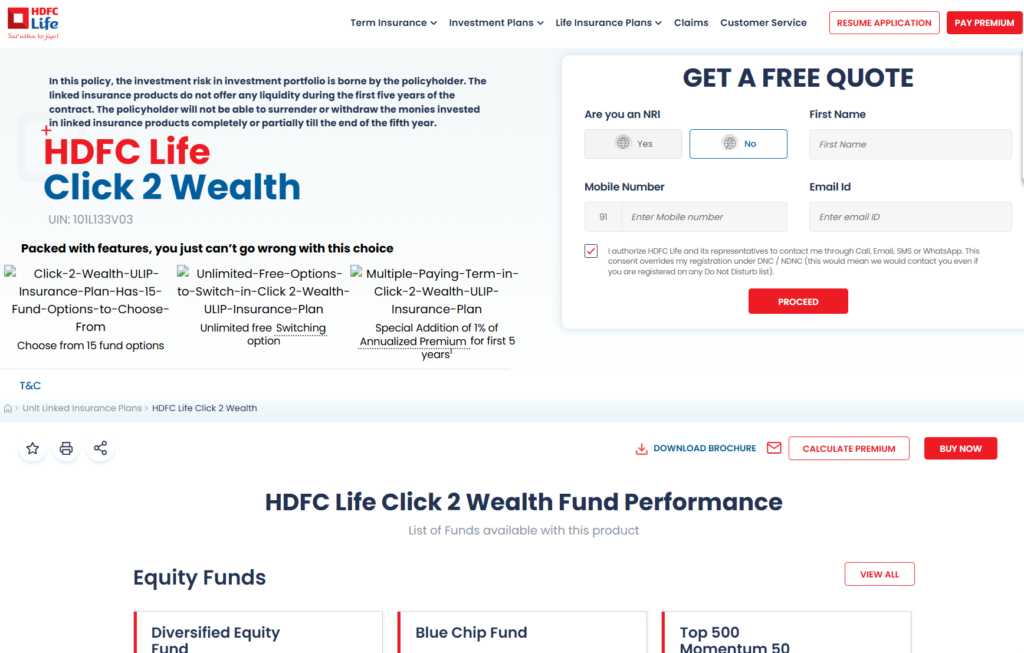

1. HDFC Life Pro Growth Plus

Features:

- Dual Advantage: Allocates funds to equity (for growth) and debt (for stability).

- Flexible Premium Payment: Choose between regular, limited, or single premium options.

- Loyalty Additions: Bonuses added after the 5th policy year.

Benefits:

- High-Growth Funds: Exposure to large-cap and mid-cap equity funds.

- Partial Withdrawals: Allowed after the 5th year.

- Tax Benefits: Under Sections 80C and 10(10D) of the Income Tax Act.

Expected Returns in 2025:

- Equity Fund CAGR: 12–14% (based on 10-year historical average).

- Debt Fund CAGR: 7–9%.

Why It’s a Top Performer:

HDFC Life’s robust fund management and consistent performance in volatile markets make it a reliable choice for long-term growth.

For More details you can visit hdfc: click 2 wealth ulip

2. LIC’s New Bima Advantage

Features:

- Dynamic Fund Strategy: Auto-shifts between equity and debt based on market conditions.

- Death Benefit: Higher of 10X annual premium or 105% of total premiums paid.

- Policy Term: 10–25 years.

Benefits:

- Guanteed Additions: 2% of the sum assured added annually after the 2nd year.

- Low Charges: Lower fund management fees (1.35% annually).

Expected Returns in 2025:

- Balanced Fund CAGR: 10–12%.

Why It’s a Top Performer:

LIC’s risk-adjusted returns and brand credibility appeal to conservative investors.

Official Document: link

3. SBI Life eWealth Insurance

Features:

- Smart Switching: AI-driven recommendations for fund switching.

- Top-Up Premiums: Increase investment during market dips.

- Rider Options: Critical illness and accidental death cover.

Benefits:

- Diversified Portfolios: Access to international equity funds.

- Online Management: User-friendly portal for tracking investments.

Expected Returns in 2025:

- International Equity Fund CAGR: 14–16%.

Why It’s a Top Performer:

SBI Life’s tech-driven approach and global diversification enhance return potential.

Official Document: link

4. ICICI Pru Wealth Builder II

Features:

- Goal-Based Investing: Customize funds for education, retirement, etc.

- Systematic Transfer Plan (STP): Gradually shift from debt to equity.

- Partial Surrender: Withdraw up to 20% of fund value after 3 years.

Benefits:

- Wealth Boosters: Additional units allocated at milestones.

- Low Mortality Charges: Cost-effective life cover.

Expected Returns in 2025:

- Multi-Cap Fund CAGR: 13–15%.

Why It’s a Top Performer:

ICICI’s focus on goal alignment and flexible withdrawals suits millennials.

Official Document: link

5. Max Life Fast Track Super

Features:

- Accelerated Wealth Creation: Higher equity allocation (up to 99%).

- LifeStage Options: Adjust risk profile as you age.

- Survival Benefits: Periodic payouts post the 15th year.

Benefits:

- High Liquidity: Loan facility available after 3 years.

- Bonus Units: Additional units for premiums paid on time.

Expected Returns in 2025:

- Aggressive Equity Fund CAGR: 15–18%.

Why It’s a Top Performer:

Max Life’s aggressive equity focus caters to high-risk investors seeking maximum returns.

Official Page: link

Comparison Table: Top 5 ULIP Plans (2025 Projections)

| Plan Name | Premium Range (Annual) | Policy Term | Expected CAGR (%) | Unique Feature |

|---|---|---|---|---|

| HDFC Life Pro Growth Plus | ₹50K–₹5L | 10–30 years | 12–14 | Loyalty Additions |

| LIC New Bima Advantage | ₹30K–₹10L | 10–25 years | 10–12 | Auto Fund Rebalancing |

| SBI Life eWealth | ₹50K–₹3L | 15–25 years | 14–16 | AI-Driven Fund Switching |

| ICICI Pru Wealth Builder | ₹75K–₹2L | 10–20 years | 13–15 | Goal-Based STP |

| Max Life Fast Track Super | ₹1L–₹10L | 15–30 years | 15–18 | LifeStage Risk Adjustment |

Key Factors to Consider When Choosing a ULIP

- Fund Performance History: Analyze 5–10-year returns of underlying funds.

- Charges: Look for low mortality, administration, and fund management fees.

- Flexibility: Check switching options, top-ups, and partial withdrawals.

- Risk Appetite: Match equity-debt allocation to your comfort level.

Also Read: 7 instant personal loan app to get money instantly

FAQs

Q1. Are ULIP returns guaranteed?

No, ULIP returns are market-linked and subject to equity/debt market risks.

Q2. How do ULIPs compare to mutual funds?

ULIPs offer insurance + investment, while mutual funds focus solely on wealth creation.

Q3. What are the tax benefits?

Premiums up to ₹1.5L under Section 80C; maturity proceeds tax-free under Section 10(10D).

Q4. Can I exit a ULIP early?

Yes, but surrender charges apply (typically 1–3 years).

Q5. How are ULIPs taxed on death claims?

Death benefits are tax-free for nominees.

Conclusion

The top 5 ULIP plans for 2025 highlighted here balance risk, returns, and flexibility. While HDFC Life and Max Life cater to aggressive investors, LIC and SBI Life offer stability. Always consult a financial advisor to align ULIPs with your goals.

Note: Past performance doesn’t guarantee future returns. Market risks apply.